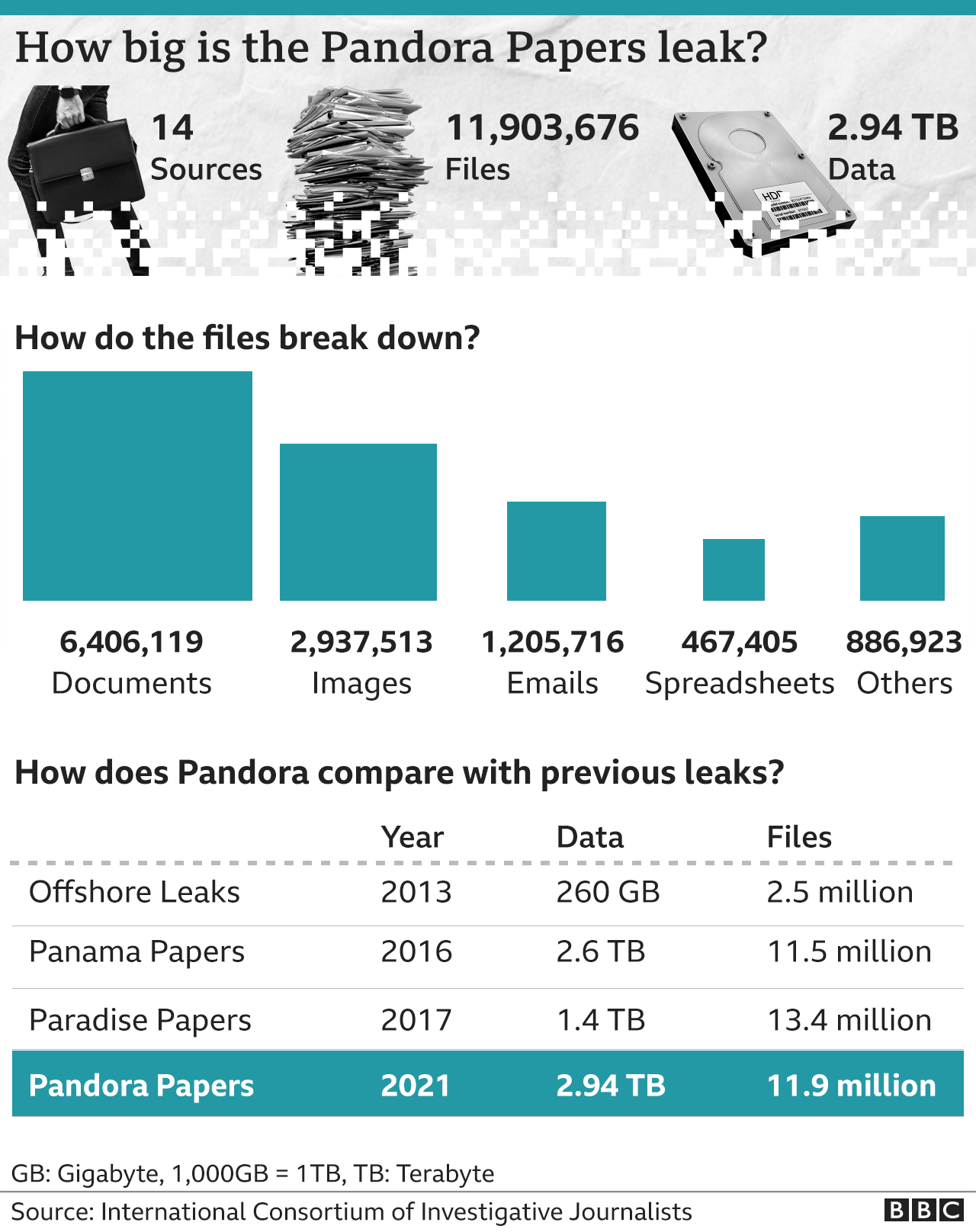

Pandora Papers is a leak of nearly 12 million documents revealing hidden wealth, tax evasion, and, in some cases, embezzlement by some of the world's richest and most powerful people.

More than 600 journalists in 117 countries have been researching 14 sources for months, receiving reports that are being published this week.

The International Criminal Investigation Association (ICIJ) in Washington DC, obtained the data, which has been working with more than 140 news organizations on its largest global investigation.

The BBC Panorama and the Guardian have led an investigation into the UK.

What are the facts?

The Pandora Papers comprises 6.4 million documents, nearly three million photographs, more than one million e-mails, and about half a million tables.

Reports so far include:

The King of Jordan's £ 70 million expenditure on assets in the United Kingdom and the United States through privately-owned companies

The secret involvement of Azerbaijan's leading family in property deals in the UK worth more than £ 400 million

The failure of the Czech prime minister to announce a foreign investment company used to buy two French buildings for 12 million pounds

How the family of Kenyan president Uhuru Kenyatta has secretly owned a network of companies with tax-exempt countries for decades.

The documents reveal how some of the world's most powerful people - including more than 330 politicians from 90 countries, use secret coastal companies to hide their wealth.

Lakshmi Kumar from the American Think-tank organization explained that these people "can make money, exploit and hide it," often through secret companies to hide their wealth.

What does it mean to open companies in tax-exempt areas (offshore)

Pandora Papers exposes complex corporate networks that are outside the borders, which are often used to hide ownership of money and property.

For example, a person may own property in the UK, but own it through a chain of companies located in other countries, or “companies opened in tax-exempt areas.

Countries, where tax exemptions are available, have the following characteristics;

It is easy to set up companies

some rules make it difficult to identify company owners

There is little or no tax

These areas are often referred to as places of tax exemption or secrecy authority. There is no definite list of tax-exempt areas, but the most popular areas include the British Overseas Areas such as the Cayman Islands and the British Virgin Islands as well as countries such as Switzerland and Singapore.

Is it illegal to use tax-exempt countries?

Gaps in the law allow people legally to avoid paying taxes by transferring their money or setting up a company in those areas, but they are often seen as immoral. The UK government says tax avoidance "involves operating within the letter, but not the spirit, of the law".

There are also several legitimate reasons why people may want to hold on to money and property in different countries, such as protection against criminal attacks or self-defense against unstable governments.

Although having secret assets in these areas is not illegal, using a complex network of secret companies to swindle money and assets is a good way to hide criminal income.

There have been repeated calls for politicians to make it harder to evade taxes or hide assets, especially following previous leaks such as Panama documents.

But Mr. Ryle said Pandora's documents show that "people who can end secrecy in tax-free countries ... also benefit from it. So there is no incentive for them to end it".

How easy is it to hide money in tax-exempt areas?

All you have to do is set up a company in one of the world's most secretive countries. The company will remain the only name, without office or staff.

It costs, however. Expert companies are paid to set up and run such companies on your behalf. These companies can provide the addresses and names of paid directors, so they cannot disclose who owns the business.

How much money is hidden?

It is impossible to say for sure, but estimates have ranged from $ 5.6 trillion to $ 32 trillion, according to the ICIJ. The International Monetary Fund has said the use of cheap tax areas costs the government worldwide up to $ 600 billion in taxes that are lost annually.

Ms. Kumar said it was bad for the whole community: "The ability to hide money has a direct impact on your life ... it affects children's education, health care, and housing."

What is the UK doing?

The UK has been criticized for allowing a property to be owned by unknown companies abroad.

The government published a draft law in 2018 that would require owners of British property to be declared. But it is still awaiting submission to lawmakers.

A 2019 parliamentary report said the UK system is attracting people "like money launderers, who may want to use assets to hide illegal money".

It said criminal investigations are often "blocked" because police cannot see who ultimately owns the property.

The government recently increased the risk of money laundering from "medium" to "high" rates.

It says it strongly opposes acts of embezzlement and strict law enforcement, and that it will establish a register of foreign companies owning British property when parliament allows it.